Bonds in a diversified portfolio

The global bond market generates significantly less attention than equity markets. It may surprise many people to learn that the market for bonds is in fact larger than equities. At the end of 2020, the sum of the market capitalisation of all global stock markets was $US106 trillion, and the size of the global bond market was $US124 trillion. Bonds play a critical role in global capital markets, and they are also an important part of building diversified portfolios for investors.

What are the basics of bonds? How do the risks and returns compare to equities? And why do bonds act as an important diversification tool in balanced portfolios?

The basics of bonds

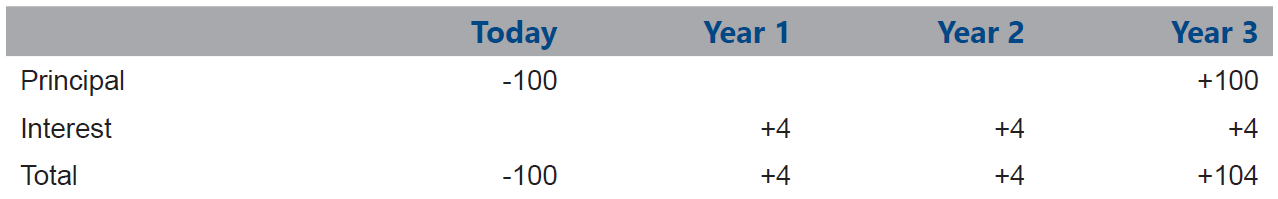

In simple terms, a bond represents a loan that is made to a government, bank or a company. There will usually be two components. The first in the principal, or face value of the bond. This represents the amount that is borrowed, and will be repaid at the end of the loan term once the bond matures. The second is the coupon amount, which represents the interest payments that are due. This can either be a fixed amount or a variable amount. Table 1 represents the cash flows for a bond with $100 face value, a 4% coupon (or yield), and a term of 3 years:

Table 1: Bond cashflows

Source: Fiducian

Bonds are generally considered safer than equities as payments need to be made to bondholders before anything can be distributed to shareholders.

There are a number of factors that determine the yield on a bond. The first one is a ‘base rate’- what interest rate can you get paid for taking virtually no risk. US Government bonds are considered extremely low risk, as are most developed market government bonds. The second main factor is the risk of the entity that is issuing the bond, and the relationship between the perceived risk of an asset and its expected return holds true. The higher the risk that the issuer of the bond will not pay the money back, the higher the yield demanded by investors.

For example, the 10 year US government bond currently yields about 3.0%. A riskier basket of lower grade US corporate debt will currently yield about 7.5%.

Credit quality is a critical issue for investors to consider. Occasionally, companies will promote their returns as ‘safe’ or ‘secured’, but are in fact been far riskier than what is represented. The default of high grade corporate or government debt is historically very rare.

Long term risks and returns

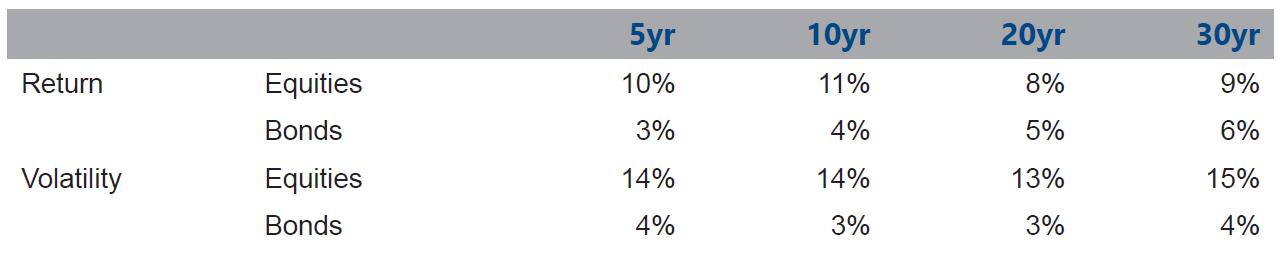

The overall lower risk profile of bonds means that the long term returns of the asset class are also lower. Table 2 compares the returns of the Australian stocks (ASX 300) with Australian bonds (Bloomberg all composite index) over long time periods, and also considers the risk, or volatility, of the returns:

Table 2: Long term returns and volatility

Source: ASX, Bloomberg, Fiducian

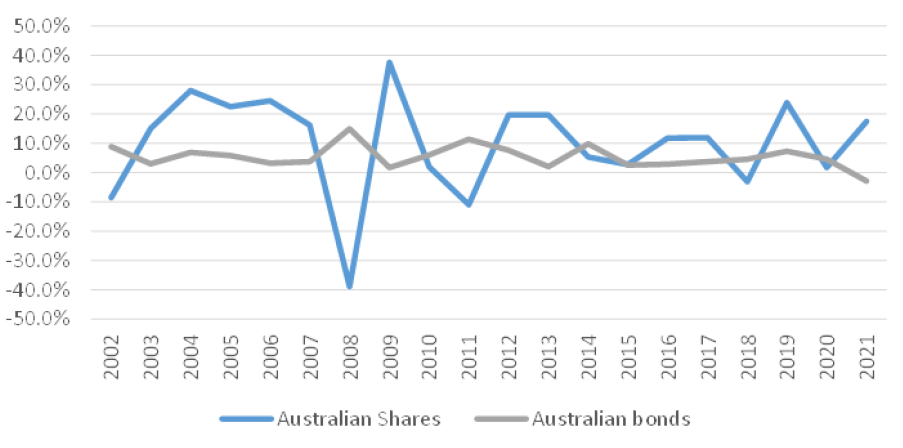

For the last 10 years, the annualised returns from stocks was 11%, but with a relatively high volatility of 14%. For bonds, the annualised return was materially lower at 4%, but volatility was also far lower at only 3%. This can be seen in Figure 1, where the grey line, representing bonds, is far more stable than the blue line, representing stocks:

Figure 1: Annual returns of shares and bonds

Source: ASX, Bloomberg, Fiducian

It is important to note that the underlying securities in bond portfolios typically aren’t all held to maturity. Until late 2021, bond yields were trading at close to historic lows, and when yields go lower, the price of a bond increases. This means for much of the last few decades, there has been a capital gain component associated with holding bonds as interest rates have been falling. If interest rates and bond yields move higher, capital losses can also be generated. This will lower the overall return, and sometimes make it negative, as has occurred in the last few months as interest rates have increased across the globe.

With the higher long term returns on offer from equities, what is the purpose of having bonds as a part of a diversified portfolio, especially for investors with a long time horizon?

Low correlations

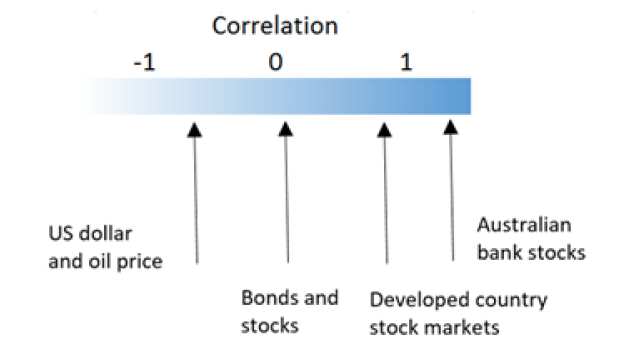

Diversification is an important concept in finance, and Modern Portfolio Theory states that individual asset returns should not be looked at in isolation, that it is also important to consider the correlations of returns. This can be used to build portfolios that have a lower level of risk for a targeted level of returns. Assets that move together perfectly have a correlation of 1, assets that move in the exact opposite direction have a correlation of -1, and assets that have completely uncorrelated returns have a correlation of zero. Examples of this are shown in the Figure 2 below. Australian bank stocks, which have the same underlying profit drivers, are highly correlated. Developed country stock markets, which share a number of similar drivers, move reasonably closely together. Some asset pairs like the oil price and the US dollar typically move in opposite directions. In the Australian market, the long term correlation of stocks and bonds is close to zero.

Figure 2: Correlation example

Source: Fiducian

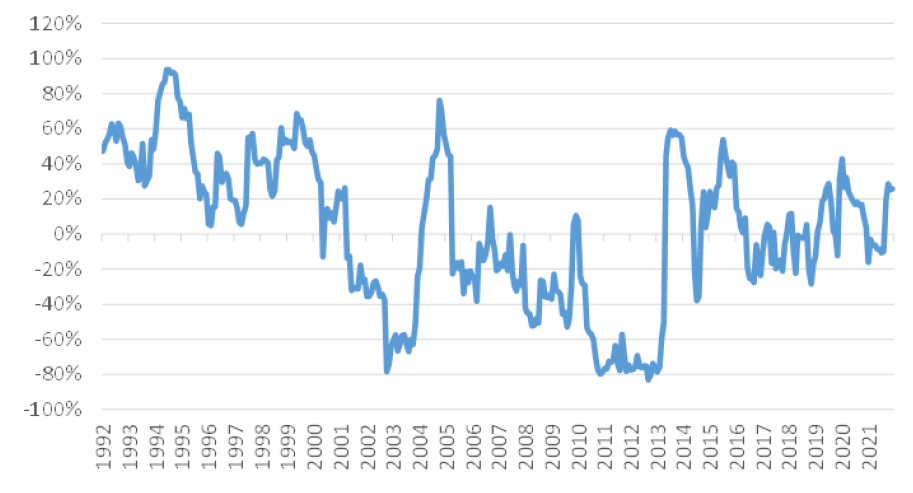

The relationship can vary over time, sometimes exhibiting positive or negative correlations, depending on the dynamics playing out in each market. The Reserve Bank of Australia has examined some of the reasons for the change in correlations over time, but the average relationship over the past 30 years has been a correlation of 2%, as can be seen in Figure 3.

Figure 3: 12 month rolling correlation of equites and bonds

Source: ASX, Bloomberg, Fiducian

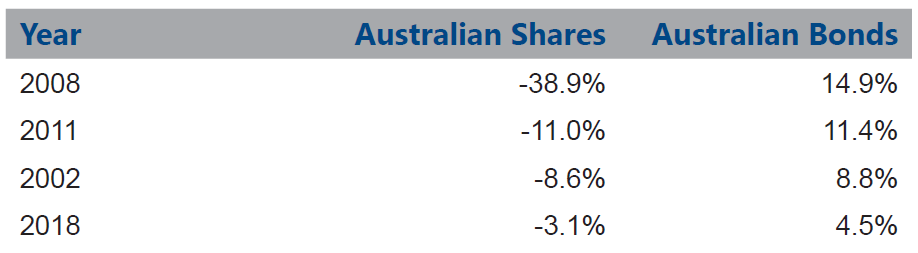

It is also important to note that over the last 20 years (2002-2021) the Australian market has had a negative calendar year return on four occasions, and each of these times, bonds generated a positive annual return, as shown in Table 3. When the stock market is fearful and sells equities, the beneficiary is often bonds.

Table 3: Worst years for equities

Source: ASX, Bloomberg, Fiducian

Practical applications

There are some clear benefits for different types of investors to consider bond allocations as a part of their portfolios:

- For investors earlier in the accumulation phase, a high allocation to growth assets is usually recommended given the long investment timeframes. Having an allocation to an asset that is less likely to drop, and possibly increase in value during times of market distress, provides some firepower to shift back into growth assets at an opportune time.

- For investors who are in or approaching the pension phase, holding an allocation to bonds should reduce the risk of experiencing large capital drawdowns. The shorter the investment horizon, the less chance investors have to regain losses. Additionally, bonds tend to provide a more reliable (but typically lower) income stream than equities.

- Individual investors are often trend followers, and on average, sell stocks at the wrong time. Reducing the downside volatility to minimise overall portfolio losses can help to fight the impulse to ‘panic sell’ at the worst time.

Overall, diversified portfolios tend to provide investors with a more stable and lower risk way to grow their wealth. The low correlation to other assets classes mean that bonds play an important part in this process.

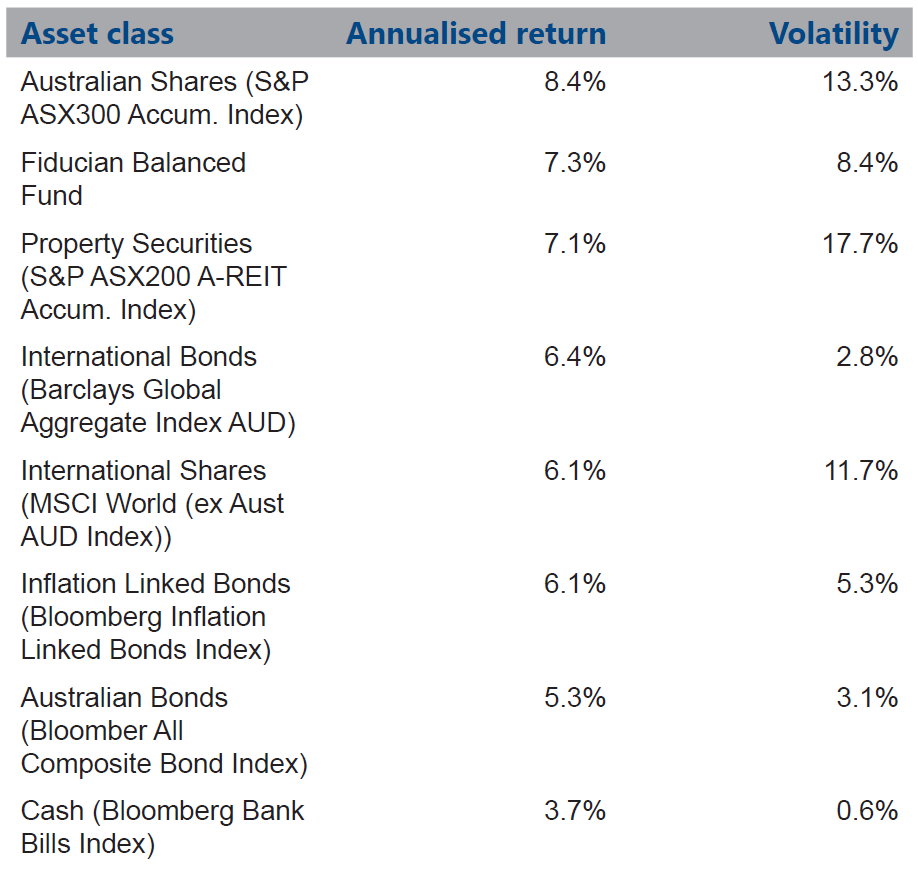

Table 4 gives example of how a diversified portfolio, in this case the Fiducian Balanced Fund, has generated strong returns over the last 20 years containing a mix of asset classes, including a strategic allocation of 30% to cash and bonds. This has been achieved with a lower volatility than asset classes with comparable returns:

Table 4: Asset class returns

Source: ASX, Bloomberg, Fiducian

Summary

Just as bonds play a critical role in global capital markets, they are also a very important component of investor portfolios. Historic returns have been lower than other asset classes, but so has risk. The low correlation of bonds to other asset classes plays a key role in portfolio construction, helping to reduce overall volatility and drawdowns, whilst providing a stable (but low) income stream.

Incorporating bonds as a part of a diversified portfolio can have benefits for a range of investors regardless of their individual time horizon.

Disclaimer

Issued by Fiducian Investment Management Services Limited (ABN 28 602 441 814, AFSL 468211) (‘Fiducian’). The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. The information in this document is given in good faith and we believe it to be reliable and accurate at the date of publication. Fiducian and its officers give no warranty as to the reliability or accuracy of any information and accept no responsibility for errors or omissions. The information is provided for general information only and is not personal advice. It does not have regard to any investor objectives, financial situation or needs. It does not purport to be advice and should not be relied on as such. Investment and tax advice should be sought in respect of individual circumstances. Except to the extent that it cannot be excluded, Fiducian accepts no liability for any loss or damage suffered by anyone who has acted on any information in this document. Past performance is not indicative of future performance and we do not guarantee any particular performance or any specific rate of return.